Make commercial property deals smoother with a VAT Loan that unlocks short-term cash flow for your clients.

The flexibility of a VAT Loan can take the pressure

off cash reserves, allowing you to retain working

capital to invest in other important business areas.

As an alternative funding line, it smooths cash flow peaks

and troughs without using up existing funds.

Could this help your clients?

Here’s how it works

Business owners could take the sting out of paying upfront VAT bills on commercial property by taking out a VAT loan with us. Our solution provides a 5 month facility to SMEs, allowing them to retain valuable cash reserves for other important business areas.

We will work with businesses, assessing individual circumstances to decide if a VAT loan would be the right choice.

Example one

COMMERCIAL PROPERTY PRICE:

▶ £500,000

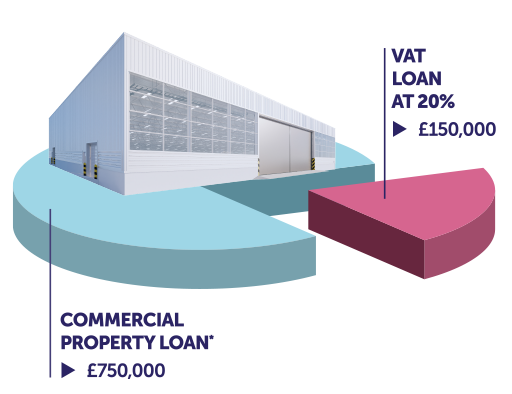

Example two

COMMERCIAL PROPERTY PRICE:

▶ £750,000

Please note these examples do not include any additional fees.

Key features

Funding for up to 100% of the VAT bill due to HMRC

Only available in conjunction with a new Cambridge & Counties Bank commercial loan*

Maximum 5 month term or until the next rebate is due

Lending criteria

*A VAT Loan is not available for commercial bridging and commercial refurbishment loans.

Get in touch with our experienced property finance team

Get in touch with our property finance team

Take a look at our Useful documents and FAQs page or get in touch with us:

Existing customers please contact:

The personal information you supply to Cambridge & Counties Bank in this form will be processed in accordance with the Data Protection Act 2018 to help your enquiry. We may share this information with other departments, or law enforcement organisations to improve service delivery or for the prevention of crime and fraud where the law allows this. Further information on how we handle your personal information can be found here.